Gap Insurance

Gap Insurance

A car is one of those assets whose value depreciates very quickly. The minute you buy a brand-new car, its value starts declining. A vehicle's value can depreciate up to 20% within a year, depending on the make, model, and use. This depreciation is not a big issue if you have financed a car for using it for a long term (decade or more). However, this quick depreciation of vehicles can become all bothersome if your car gets stolen or totaled.

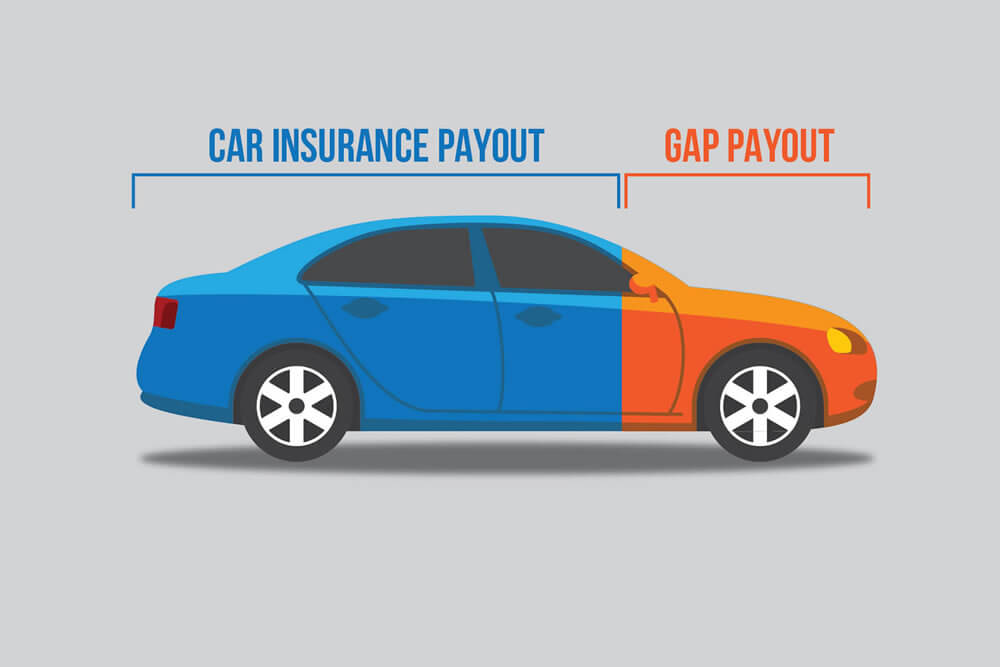

In such cases, the regular auto insurance will only cover the actual cash value (the car's value at the time of the incident). You may have to pay out of pocket for auto loan repayment to bridge the "gap" between what you get from the insurance company and what you owe the lender, and this is where "Guaranteed Auto Protection" or gap insurance kicks in. It saves you from any out of pocket repayments in the wake of your financed car getting totaled or stolen.

If you are looking for auto financing offers and searching interest rates on car loans, you also need to know what gap insurance for auto loans is. This post will walk you through all the information you need to have on gap insurance.

Insurance companies usually offer comprehensive and collision coverage in their auto insurance packages. This insurance covers you for all the instances in which your vehicle is stolen, damaged, or totaled. These types of coverage suffice when you fully own the car.

However, suppose you have financed a car, and you are in the middle of the loan repayment. The comprehensive or collision coverage will not cover the time-based depreciation for the period between when you take the new car out of the showroom and when it got totaled or stolen. You have to bridge this difference out of pocket. Gap insurance is designed to protect you from that out-of-pocket expense.

Let's try to understand how gap insurance works with the help of an example.

Let's suppose you finance a car worth $40,000 on a 5-year repayment term. After two years, the car is stolen or totaled when you still owe the lender $24,000. If your car has the collision and comprehensive coverage, the insurer will pay the lender car's actual cash value. The vehicle's two-year depreciation, its current market demand, model, and other factors will determine its value.

Let's say, the actual cash value of the vehicle turns out to be $22,000. Your insurer will pay this amount to the lender. However, the actual amount you owe to the lender is $24,000. You have to pay the remaining $2,000 out of your pocket. If your financed car also has gap insurance, the insurer will also cover you for that $2,000.

Why and When You Should Opt for Gap Insurance

The above example has clearly outlined how gap insurance works and saves you from out-of-pocket expenses. However, it is not something you should sign up for without factoring in a couple of things. Here, we are going to outline all the factors you need to consider for deciding whether you should opt for gap insurance or not.

You need to get gap insurance for your car when it is still new (no more than two to three years old). If you are wondering: "Can I refinance my car loans and then get gap insurance on the vehicle?" Yes, you can do that as long as you apply for refinancing within a year or two. We recommend you buy gap insurance as you apply for auto loans, especially for a brand-new car.

Remember that gap insurance just pays your debt on a car that has been stolen or damaged beyond repair (can't be driven). It is not going to get you a replacement vehicle. For that, you need to take another route (more on that later).

We will now review certain conditions where you need to assess your unique loan situation to decide if gap insurance is worth your money.

Down Payment

Whether you need gap insurance or not depends on how you proceed with the down payment on your auto loan. If you are paying no down payment or significantly less amount upfront, you should opt for gap insurance. With no or minimal down payment, you will owe a large sum of money to the lender if the car is stolen or totaled. Owing a large sum means potentially a wider gap between the payable amount to the lender and the vehicle's depreciated value.

If you have paid a hefty down payment, your comprehensive/collision coverage may cover almost all the amount you owe to the lender. And even if you have to pay out of pocket, the amount will be nominal and less than what you have to pay for gap insurance.

Loan Term

If you have signed up for a longer loan term, gap insurance will come handier. A car depreciates more on a longer repayment term, which increases the gap between the owed money and actual cash value in case of a stealing or totaling incident. If your loan term is within 48 months, gap insurance will not make any big difference.

Mileage

As a car owner, you would know how much time you will spend at the wheel. If your car involves long routes, rush hours, or in short, more intensive use, you should sign up for gap insurance. We all know that intensive use with more mileage recorded tends to reduce the car's value more quickly.

Some car model also depreciates faster than the others. You should run a background check on the car you want with auto geeks and mechanics to know its depreciation index.

We can't give an actual cost of gap insurance. It depends on multiple factors and thus varies too much. Usually, auto insurers will charge you in the range of $20 and $50 for gap insurance on top of your comprehensive and collision coverage. Many auto loan lenders also offer a lump-sum fee of around $500-$800 on gap insurance. You can also find gap insurances as low as $300 from some online lenders and dealerships.

As mentioned earlier, gap insurance will only get you off the hook for your outstanding debt on the car that you can't longer use. It doesn't cover you for a replacement. If you want to get a new car in place of that stolen/totaled car, you need to sign up for new car replacement coverage. This type of insurance will pay the lender for the damaged/totaled car and also get you the new car of the same brand and model.

After considering all factors, gap insurance can prove useful if you finance a new car with a longer-repayment term and hasn't paid a heavy amount in down payment. To find out more about gap insurance for auto loans, the best interest rates on car loans, and many other auto financing and refinancing options, visit CarLoans.com.